Trump Vows to Revoke Harvard’s Tax-Exempt Status

The Trump Administration Escalates Fight Over Harvard’s Tax-Exempt Status

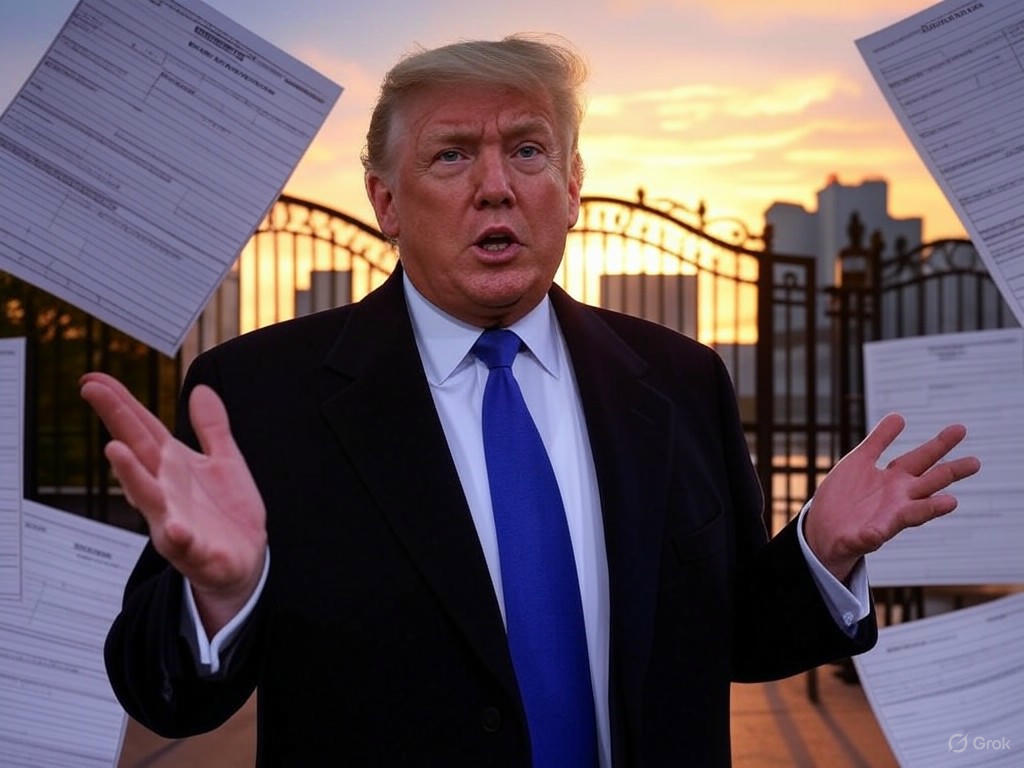

President Donald Trump made headlines on May 2, 2025, by announcing his administration’s plan to revoke Harvard’s tax-exempt status, a move that could reshape the landscape of American higher education. This bold declaration on Truth Social highlights growing tensions between the federal government and elite universities, with Harvard tax-exempt status now at the center of a heated debate. As one of the nation’s oldest institutions, Harvard has long enjoyed this privilege, but Trump’s vow signals a potential shift in how educational nonprofits are scrutinized.

At stake is Harvard’s 501(c)(3) designation, which shields it from federal taxes and encourages donations through tax deductions. Imagine a world where such exemptions could be stripped based on political disagreements—what might that mean for other schools? This isn’t just about one university; it’s a flashpoint for broader discussions on accountability and public interest.

What’s at Stake in the Harvard Tax-Exempt Status Dispute

Harvard’s tax-exempt status allows it to operate without paying federal income taxes, a benefit that supports its massive $52.3 billion endowment. Revoking this could force the university to rethink its funding strategies, potentially taxing endowments and discouraging donor contributions. Have you ever wondered how universities like Harvard sustain their world-class research and scholarships? It’s largely thanks to this exemption, which now faces an unprecedented threat.

The financial fallout could be enormous, affecting everything from student aid to groundbreaking studies. Critics argue this status is meant to serve the public good, but the Trump administration claims Harvard has fallen short, especially amid allegations of campus controversies.

Recent Administration Actions Targeting Harvard Tax-Exempt Status

The push to challenge Harvard’s tax-exempt status builds on prior moves by the Trump administration, including freezing $2.2 billion in grants and suspending $60 million in contracts. These steps stem from disputes over diversity programs and hiring practices, escalating into a full-scale confrontation. For context, international students make up about 27% of Harvard’s enrollment, and threats to limit their access add another layer of complexity.

This pattern of punitive actions raises questions: Is this a targeted effort to influence university policies, or a broader signal to other institutions? Either way, it’s a stark reminder of how federal funding and tax exemptions can be used as leverage.

Legal Hurdles in Revoking Harvard’s Tax-Exempt Status

The legality of Trump’s announcement is already under fire, with experts pointing to restrictions on executive interference in IRS matters. Harvard has quickly pushed back, asserting that there’s no valid basis for altering its tax-exempt status, which could lead to lengthy court battles. Drawing from historical cases, this situation echoes the Bob Jones University precedent from the 1970s and 1980s, where tax exemptions were revoked over discriminatory policies.

In that case, it took over a decade to reach the Supreme Court, and similar timelines might apply here. What does this mean for academic freedom? It could set a dangerous precedent, allowing political agendas to interfere with educational institutions’ operations.

The Bob Jones University Case as a Precedent for Harvard Tax-Exempt Status

The Bob Jones University saga serves as a key reference point for any attempt to revoke Harvard’s tax-exempt status. In 1970, the IRS moved against the university for its discriminatory practices, ultimately upholding the revocation in 1983. Tax law experts, like Yale’s Michael Graetz, suggest this could guide future rulings, making the process neither swift nor simple.

Harvard’s defenders argue that its contributions to society—through research, housing initiatives, and healthcare—far outweigh any alleged missteps. This isn’t just about one case; it’s about protecting the principles that underpin nonprofit exemptions.

Why the Administration is Challenging Harvard’s Tax-Exempt Status

The Trump administration’s justifications center on accusations of antisemitism and a failure to act in the public interest. Specifically, they point to Harvard’s handling of protests related to the Israel-Hamas conflict, which triggered reviews of over $9 billion in federal grants. Trump’s stance is clear: Harvard tax-exempt status should be tied to serving the broader public, not advancing what he calls “political sickness.”

This rhetoric frames the debate as one of accountability, but critics see it as an overreach into academic autonomy. For instance, Harvard’s partnerships with hospitals and community programs demonstrate its public service role—could taxing it jeopardize these efforts?

Allegations of Antisemitism and Public Interest in Harvard Tax-Exempt Status

At the heart of the administration’s case is the claim that Harvard hasn’t done enough to combat antisemitism, potentially violating civil rights laws. This has led to funding freezes and increased scrutiny, with Trump arguing that tax exemptions must align with national values. Yet, even allies in the fight against hate, like the Anti-Defamation League, have called this an “overreach,” warning of unintended consequences.

It’s a tricky balance: How do we address real issues without weaponizing federal power? This situation invites us to consider the broader implications for all universities relying on tax-exempt status.

Wider Context and Effects on Higher Education’s Tax-Exempt Status

This conflict reflects a growing divide between the government and academia, with elite schools often criticized for promoting progressive views. Harvard’s extensive research in medicine and science—tied to 15 hospitals—could suffer if funding is cut, impacting public health advancements. Picture the ripple effects: from affordable housing units to food insecurity programs, Harvard’s role in society is vast.

The potential loss of Harvard tax-exempt status might encourage other institutions to self-censor or alter policies, altering the educational ecosystem. As one expert noted, using the IRS as a tool for policy could backfire, rallying supporters from alumni to researchers.

Impact on Research and the Future of University Tax-Exempt Status

Most of the frozen funds were earmarked for scientific research, raising alarms about setbacks in fields like medicine. Universities nationwide are watching closely, fearing that their own tax-exempt status could be next if political winds shift. This isn’t hypothetical; it’s a real threat that could change how schools operate and innovate.

Engage with this: What steps might universities take to safeguard their exemptions? Building stronger community ties and transparent practices could be a smart strategy moving forward.

Potential Outcomes and Backlash from Challenging Harvard’s Tax-Exempt Status

History shows that aggressive use of tax authority can lead to widespread resistance, from alumni networks to congressional oversight. Stakeholders, including families relying on Harvard’s healthcare services, might mobilize against this. It’s a scenario that could unite diverse groups, from local communities to academic advocates, in defense of institutional independence.

If successful, this could open the door for more interventions, but at what cost? We might see a backlash that strengthens protections for higher education overall.

What’s Next in the Battle Over Harvard Tax-Exempt Status?

Expect a drawn-out legal fight, with Harvard likely filing suits to block any revocation. Congressional hearings could also play a role, debating the ethics and implications of such moves. If the Bob Jones case is any guide, resolution might take years, giving time for public opinion to evolve.

This is a pivotal moment—will it result in reforms or reinforce existing safeguards? Stay tuned as developments unfold.

Broader Implications for the Future of Tax-Exempt Status in Higher Education

The outcome could redefine federal-university relations, potentially allowing governments to influence everything from curricula to hiring. Other schools are already assessing their vulnerabilities, making this a wake-up call for the sector. In a hypothetical scenario, a smaller college might face similar threats, prompting nationwide advocacy for reform.

Here’s a tip: Universities could proactively demonstrate their public value through annual reports and community engagements to bolster their case for tax-exempt status. It’s about being proactive in an uncertain environment.

Wrapping Up: The Lasting Impact on Harvard Tax-Exempt Status

Trump’s vow marks a watershed in U.S. higher education, with potential to alter funding models and operational freedoms. As this unfolds, it’s crucial to weigh the balance between accountability and autonomy. What are your thoughts on this clash—does it signal needed change or risky overreach?

I encourage you to share your insights in the comments below, explore related topics on our site, or spread the word to spark more discussion. Let’s keep the conversation going—your perspective matters.

References

- CBS News. “Trump says revoking Harvard’s tax-exempt status.” Link

- Politico. “Trump vows to revoke Harvard’s tax-exempt status.” Link

- Politico Magazine. “The history of Trump and Harvard’s tax-exempt status.” Link

- Harvard Office of the Controller. “Harvard University tax-exempt organization FAQ.” Link

- WHCP. “History shows revoking Harvard’s tax status won’t be easy or fast.” Link

- The White House Archives. “Economic Report of the President 2023.” Link

- American Academy of Arts and Sciences. “Humanities in American Life.” Link

- ACCC. “Impact of digital platforms on news and journalistic content.” Link

Harvard tax-exempt status, Trump Harvard, 501(c)(3) revocation, Harvard federal funding, university tax exemption, Trump administration education policy, higher education tax disputes, IRS and universities, academic freedom threats, nonprofit status challenges