Nvidia Stock Drops as Huawei Advances AI Chip Amid Ban

How Huawei’s AI Chip is Fueling the Nvidia Stock Drop

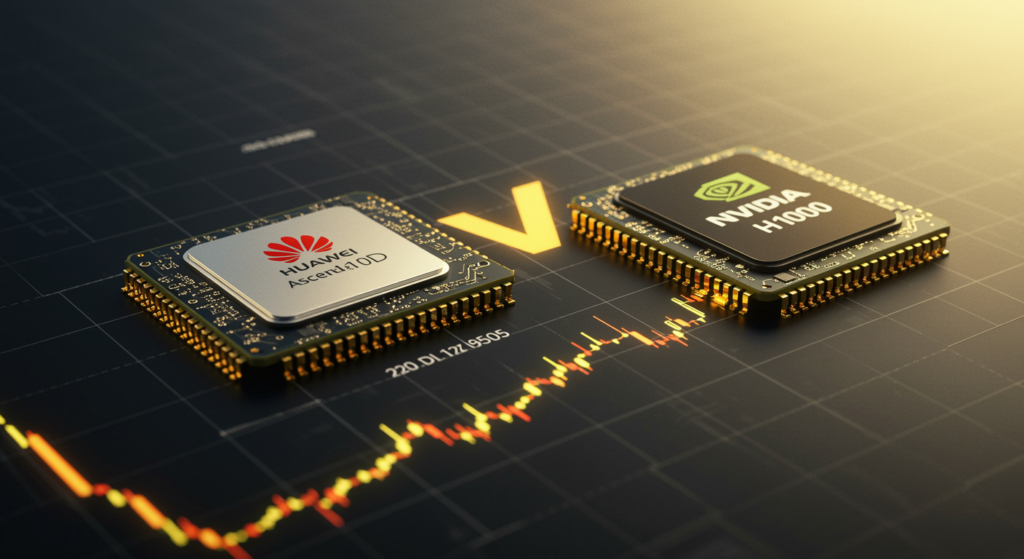

The global AI chip market is in flux, with Chinese tech leader Huawei pushing forward despite mounting challenges. The Nvidia stock drop of 2% in early Monday trading stems from reports that Huawei is crafting a new AI chip potentially surpassing Nvidia’s H100 processor[1]. This shift highlights how US export bans are reshaping the semiconductor world, forcing companies like Nvidia to navigate a tougher landscape.

Have you ever wondered how geopolitical tensions can ripple through stock markets? In this case, stricter US controls on AI chips to China are directly hitting Nvidia’s revenue streams. Huawei’s Ascend 910D isn’t just a product—it’s a bold step toward China’s tech independence, making the Nvidia stock drop a wake-up call for investors watching the AI race.

The Ascend 910D: Huawei’s Response to Restrictions and the Nvidia Stock Drop

Reports from The Wall Street Journal reveal Huawei is reaching out to Chinese firms to test its Ascend 910D AI processor, positioning it as a rival to Nvidia’s H100 chip[3]. This move comes as the Nvidia stock drop underscores investor worries about lost market share in China. First samples of the Ascend 910D are slated for late May 2025, a key moment in Huawei’s quest for self-reliance amid export curbs.

It’s fascinating to see how innovation thrives under pressure—what if Huawei’s chip really matches Nvidia’s performance? This processor builds on Huawei’s Ascend series, aiming to outpace the H100 in AI tasks, which could amplify the Nvidia stock drop if proven successful.

Exploring the Roots of the Nvidia Stock Drop

The Nvidia stock drop isn’t isolated; it’s tied to broader US-China dynamics. Huawei’s chip development shows how restrictions are spurring domestic alternatives, potentially eroding Nvidia’s dominance. For instance, imagine a scenario where Chinese AI firms shift entirely to local options—could that deepen the Nvidia stock drop even further?

Impact on Nvidia’s Market Position from the Recent Stock Drop

Nvidia’s shares dipped about 2% on April 28, 2025, reflecting fears of rising competition from players like Huawei[7]. This Nvidia stock drop is part of a larger trend, with the company’s value already down over 17% in 2025 due to AI spending scrutiny and trade restrictions. It’s a reminder that even tech giants aren’t immune to global shifts.

Earlier US actions, like restricting Nvidia’s H20 chip, have led to a hefty $5.5 billion charge in the first quarter alone. Analysts predict the Nvidia stock drop could translate to a $16 billion revenue hit this year, making it essential for investors to stay informed on these developments.

Shifting Market Dynamics in China Amid the Nvidia Stock Drop

Beijing’s drive for tech self-sufficiency is accelerating, with Huawei at the forefront. As the Nvidia stock drop highlights vulnerabilities, Chinese firms are ramping up local chip purchases to counter US bans. Huawei’s progress, from the Mate 60 Pro smartphone to the Ascend series, shows remarkable resilience.

By shipping over 800,000 Ascend 910B and 910C chips, Huawei is gaining ground with clients like ByteDance. This could exacerbate the Nvidia stock drop if more companies follow suit, creating a ripple effect in the AI ecosystem.

The Broader Context: US-China Tech Competition and Nvidia’s Stock Drop

This isn’t just about chips; it’s about a growing divide in global tech. The Nvidia stock drop symbolizes how export controls are forcing a decoupling, with China accelerating its own innovations. Restrictions now cover not only high-end chips like Nvidia’s H100 but also components, complicating supply chains.

Nvidia’s China sales have plummeted from 26% in 2022 to just 13% in 2025, directly linked to these policies. What does this mean for the future? It might lead to parallel tech worlds, where the Nvidia stock drop is just the beginning of more localized markets.

Huawei’s Strategic Approach to AI Computing in Light of Nvidia’s Stock Drop

Huawei is thinking big, not just about single chips but entire systems. Their CloudMatrix 384, which links Ascend 910C chips, offers a scalable alternative that could influence the Nvidia stock drop by providing competitive options. This approach uses arrays of chips to match performance without needing cutting-edge individual processors.

While Huawei sticks to 7nm production for now, this strategy might help mitigate the effects of the Nvidia stock drop for Chinese developers. It’s a smart pivot—by focusing on efficiency, they’re building a robust infrastructure that could reshape AI computing.

The Evolving AI Landscape in China and Its Tie to Nvidia’s Stock Drop

China’s AI scene is booming, with companies like Baidu and Alibaba pushing boundaries. Baidu’s Ernie 4.0 rivals GPT-4, and firms are increasingly turning to domestic chips amid the Nvidia stock drop. This diversification is creating a vibrant ecosystem, potentially reducing reliance on Western tech.

Groups like the “Six Little Tigers” are adapting quickly, using chips from Huawei and Baidu. For readers interested in AI’s future, ask yourself: could this innovation wave turn the Nvidia stock drop into a catalyst for global advancements?

Global Implications and Future Outlook Beyond the Nvidia Stock Drop

The rivalry between Huawei and Nvidia reflects a larger geopolitical struggle, likely leading to a more fragmented AI market. Companies operating in both US and Chinese spheres will need to adapt, perhaps by diversifying suppliers to avoid another Nvidia stock drop scenario.

Experts like Kai-Fu Lee warn against complacency, suggesting China’s environment might foster faster AI adoption. This competition could spur innovation, turning challenges into opportunities for the tech world.

Key Takeaways from the Nvidia Stock Drop Saga

Huawei’s Ascend 910D poses a real threat to Nvidia’s lead, especially with US bans in play. The Nvidia stock drop serves as a barometer for how these tensions are affecting investments and revenue. For the industry, this points to emerging tech ecosystems that could redefine standards.

As tests for the Ascend 910D approach in late May 2025, the results might amplify or ease the Nvidia stock drop. Stay tuned—understanding these shifts could help you make smarter decisions in your own tech investments.

So, what are your thoughts on this evolving tech battle? If you’re tracking AI stocks, consider sharing your insights in the comments or exploring more on how global policies shape innovation. Don’t forget to check out related articles on our site for deeper dives.

References

- [1] Economic Times. “Nvidia Stock Drops as Huawei Unveils New AI Chip Amid US Export Ban.” Link

- [2] Substack Post. “Title of Post.” Link

- [3] Investing.com. “China’s Huawei to Test New AI Chip Aimed at Rivaling Nvidia – WSJ.” Link

- [4] CoinTelegraph. “China-Based Huawei to Test AI Chip Aiming to Rival Nvidia: Report.” Link

- [5] Telecoms Chamber. “Huawei Prepares to Test Advanced AI Chip.” Link

- [6] FTSG Report. “2025 Technology Report.” Link

- [7] Economic Times. “China’s Huawei Develops New AI Chip Seeking to Match Nvidia – WSJ Reports.” Link

- [8] ITIF. “China is Rapidly Becoming a Leading Innovator in Advanced Industries.” Link

Nvidia stock drop, Huawei AI chip, Ascend 910D, US export ban, Nvidia H100 chip, AI semiconductor competition, China tech tensions, global chip market, Nvidia revenue impact, Huawei semiconductor advancements